Professional FX Swing Trader

Mustafijur Rahman

Specializing in Wave & SMC Theory. Managing funded capital with strict risk models. My philosophy is non-negotiable: Risk First. Profit Second.

About Me

A Funded Swing Trader and Technical Analyst specializing in major currencies and crypto assets. My mission is to grow capital through patience, structure, and strict risk discipline…. read more

Mastering the Art of Patience, Precision, and Risk Management.

My trading journey shifted when I stopped chasing indicators and started tracking institutional capital. Specializing in Smart Money Concepts (SMC) and Elliott Wave Theory, I focus on the ‘Why’ behind price movement. I don’t trade every day. Instead, I wait patiently for the market to enter my specific zones of interest on the Daily and 4-Hour charts, ensuring high-probability execution over random guessing.

Precision execution. Zero guesswork.

I treat trading as a business, not a casino. Based in Dhaka, my goal is to build long-term generational wealth through discipline and consistency. I believe that Risk Management is the only Holy Grail. By strictly risking 1.5% max per trade and controlling my emotions, I survive market volatility where others blow accounts. My job is not just to make money, but to keep it.

Longevity is the only metric that matters.

My Trading Methodology

A systematic approach combining institutional logic, structural mapping, and mathematical defense to navigate the global markets.

Wave Theory

Markets are not random; they are fractal. I utilize Elliott Wave Theory to map the psychological structure of the market, allowing me to anticipate cyclical turning points. This provides a roadmap to understand exactly where price is within the larger trend.

Smart Money Concepts

I do not chase retail patterns. Instead, I track the footprints of institutional capital. By identifying Order Blocks, Liquidity Voids, and Mitigation zones, I align my entries with the ‘Smart Money’ that actually drives price action, ensuring high-precision execution.

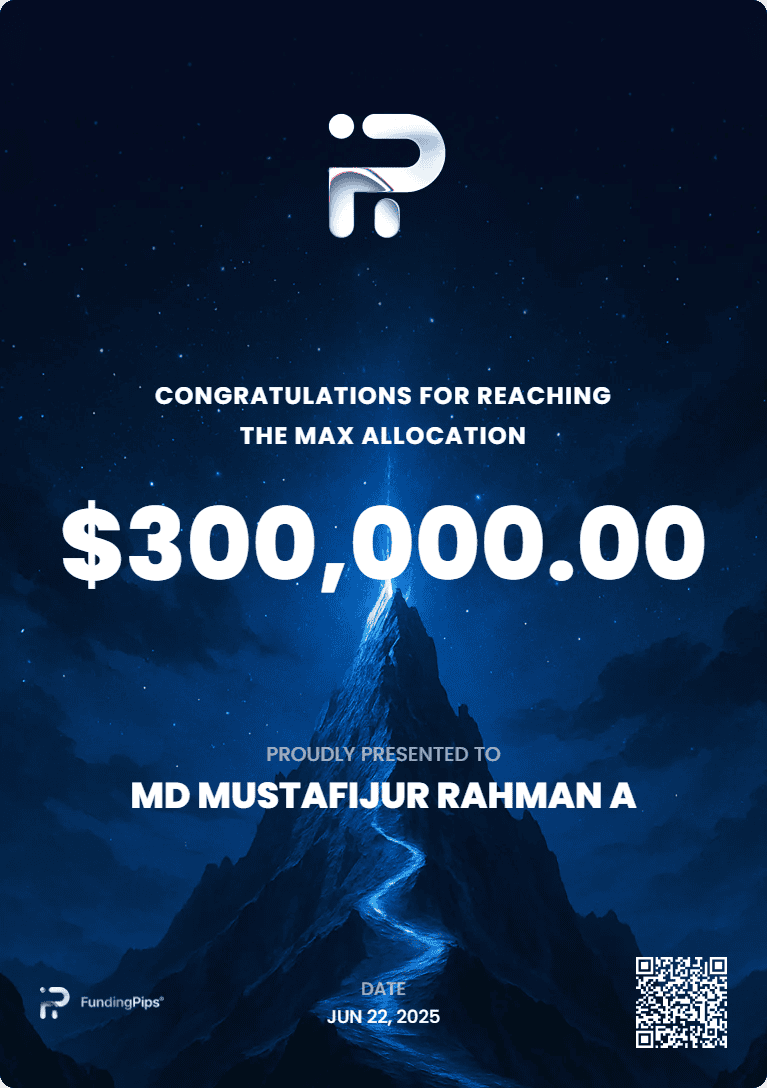

Track Record & Milestones